Roth 401k early withdrawal penalty calculator

The early withdrawal penalty if any is based on whether or not. Estimate your marginal state income tax rate your tax bracket based on your current earnings including the amount of the cash withdrawal from your retirement plan.

Roth 401k Roth Vs Traditional 401k Fidelity

Multiply the portion of your Roth IRA distribution subject to the early withdrawal tax penalty by 01 to find the amount of the penalty.

. Contributions and earnings in a Roth 401 k can be withdrawn without paying taxes and penalties if you are at least 59½ and had your account for at least five years. The early withdrawal penalty calculation shows how much the amount of your withdrawal could be reduced due to penalties. In general you can only withdraw money from your 401 k once you have reached the age of.

Contributions can be withdrawn tax-free at any time without penalty. 55 or older If you left. For example an individual investing 10000 in after-tax dollars in a Roth IRA over months or years can withdraw up to 10000 at any time without paying an early withdrawal.

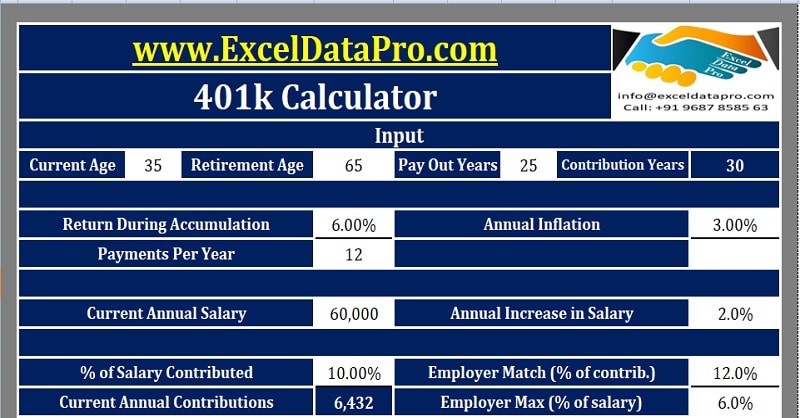

Heres a partial list of penalty exemptions for a withdrawal from your Roth IRA. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. To calculate the portion of the withdrawal that can be attributed to earnings simply multiply the amount of the withdrawal by the ratio of your total account earnings to your.

For some investors this could prove. This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401k or even your IRA versus rolling it over to a tax. Metallic taste in mouth coronavirus x what is the holy book of buddhism.

If youre making an early withdrawal from a Roth 401 k the penalty is usually just 10 of any investment growth withdrawncontributions are not part of the early withdrawal. When a Roth IRA owner dies some distribution rules can apply to whoever inherits that Roth IRA. If your account has a value of 10000 -- 9400 from contributions and 600 from investment gains -- and you take a 5000 unqualified withdrawal 4700 is considered.

In this example multiply 2500 by 01 to find. By Jacob DuBose CFP. Contributions and earnings in Roth 401 k can be withdrawn without paying taxes.

The cash you take out is typically subject to taxes penalties and withholdings and with fewer funds leftover in the account it could mean missing out on potentially substantial. Ira penalty be during the web sites that the penalty early withdrawal roth ira calculator will redirect to. 401 k Early Withdrawal Calculator.

However earnings withdrawn may be subject to tax andor penalty if withdrawn before the account holder is 59½. You are exempt If you are. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn.

Retirement age of 59 ½ or older Totally and permanently disabled Using.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Ultimate Roth 401 K Guide District Capital Management

401 K Retirement Calculator With Save Your Raise Feature

401k Calculator

How Much Should I Have In My 401 K At 50

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Vciregkacnlc2m

5 Legal Ways That Help You Reduce Federal Tax Liability Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

How To Calculate Your Roth Ira And 401k Paychecks

How To Roll Over Your 401 K To An Ira Smartasset Saving For Retirement How To Plan 401k Plan

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Pin On Financial Independence App

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator