Return on investment formula in financial management

The basic formula in computing for return on investment is. The formula for ROI is simple.

Pmp Exam Prep Return On Investment Roi Project Management Academy Resources

Operating income or EBIT earnings before interest and taxes.

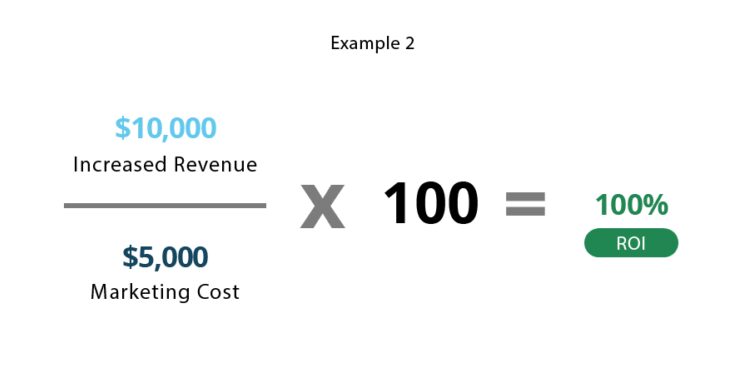

. Lets go back to our example above. Income could be one of the following. Return on investment ROI is a financial ratio expressed as a percentage used as a metric to evaluate investments and rank them compared to other investment choices.

The Return on Investment ROI tool is a means to compare profits to costs to determine if funds were used effectively. There are two ways to calculate your return on investment. The Return on Investment formula is as follows.

Lets put it in the formula and see if the the board and chairperson approve the campaign. Return on investment or ROI is a formula used to calculate the potential profit or loss of a particular financial investment or institution. Traditional ROI is calculated with a.

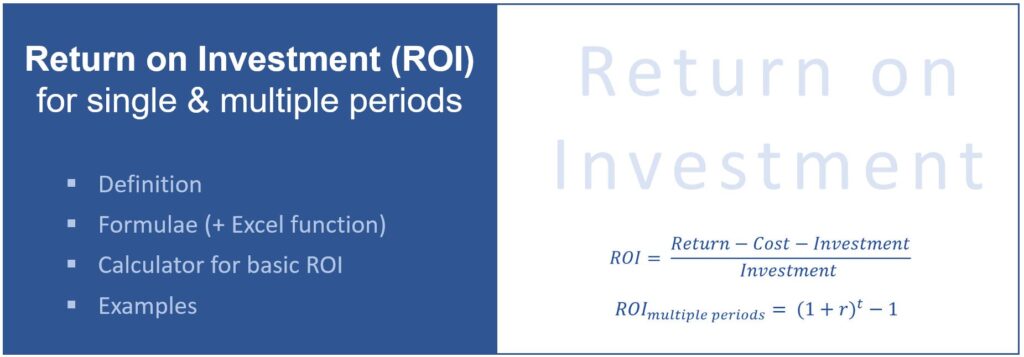

The calculation formula of the return on investment. Calculation of Monthly Return on Mutual Fund. For financial investments this may include for.

Ad Refine Your Retirement Strategy with Innovative Tools and Calculators. Click here to see how Fisher Investments delivers clearly better money management. The Multi-Year ROI Formula.

Ad Were not only legally obligatedweve built our business around putting clients first. Return on investment benefit of the investment cost of investment cost of the investment. ROI can be used as a predictive tool with expected profits and costs to.

ROI multiple periods cumulative return over all periods. Annualized ROI 1 ROI1n 1 x 100. Where r Return on the mutual fund.

The benefit can be. NAV t-1 Net assets value at time period t-1. An organisation can use Return on Investment formula to evaluate the potential profits gained from an investment while an investor can.

Ad Our Resources Can Help You Decide Between Taxable Vs. Another name for ROI is return on costs. In this formula n means the number of years youre holding the investment or the holding period.

ROI is computed as forecast or actual investment gains or losses minus costs divided by initial investment cost. NAV t Net assets value at time period t. For small businesses the return on investment ROI ratio sometimes known as the return on assets ratio is a profitability measure that evaluates the.

ROI Net Profit Cost of Investment. Pessimistic Return On Investment example Calculation. You first subtract the initial cost of the.

Wide Range of Investment Choices Access to Smart Tools Objective Research and More. An organisation can use Return on Investment formula to evaluate the potential profits gained from an investment. ROI Final Value of Investment - Initial Cost of Investment Initial Cost of Investment x 100.

Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. I t Income at. 240 200200 x 100.

Return On Investment Ratio Guide To Return On Investment Ratio

Return On Investment Roi Definition Equation How To Calculate It

Return On Investment Roi Formula And Calculator Excel Template

Return On Investment Ratio Guide To Return On Investment Ratio

5 Easy Ways To Measure The Roi Of Training

Rate Of Return Formula Calculator Excel Template

Return On Investment Single Multi Period Roi Formulae Examples Calculator Project Management Info

Difference Between Roi And Ri Termscompared

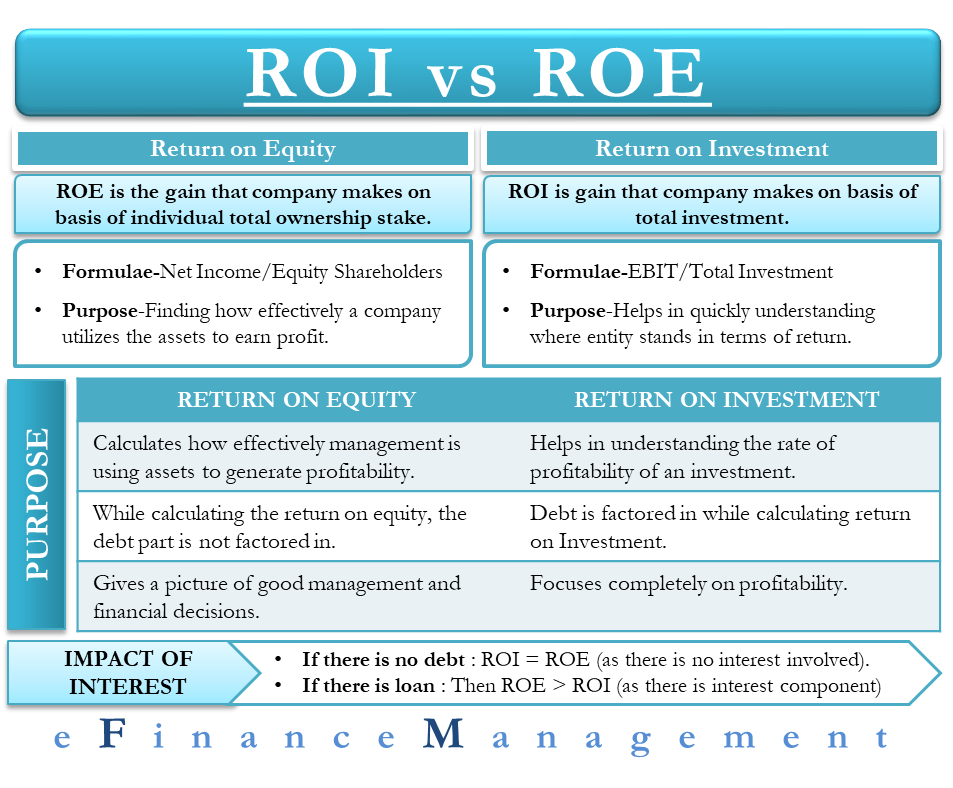

Roi Vs Roe All You Need To Know

How To Calculate Roi To Justify A Project Hbs Online

Return On Investment Roi Definition Equation How To Calculate It

.jpg)

Return On Investment Roi Formula Meaning Investinganswers

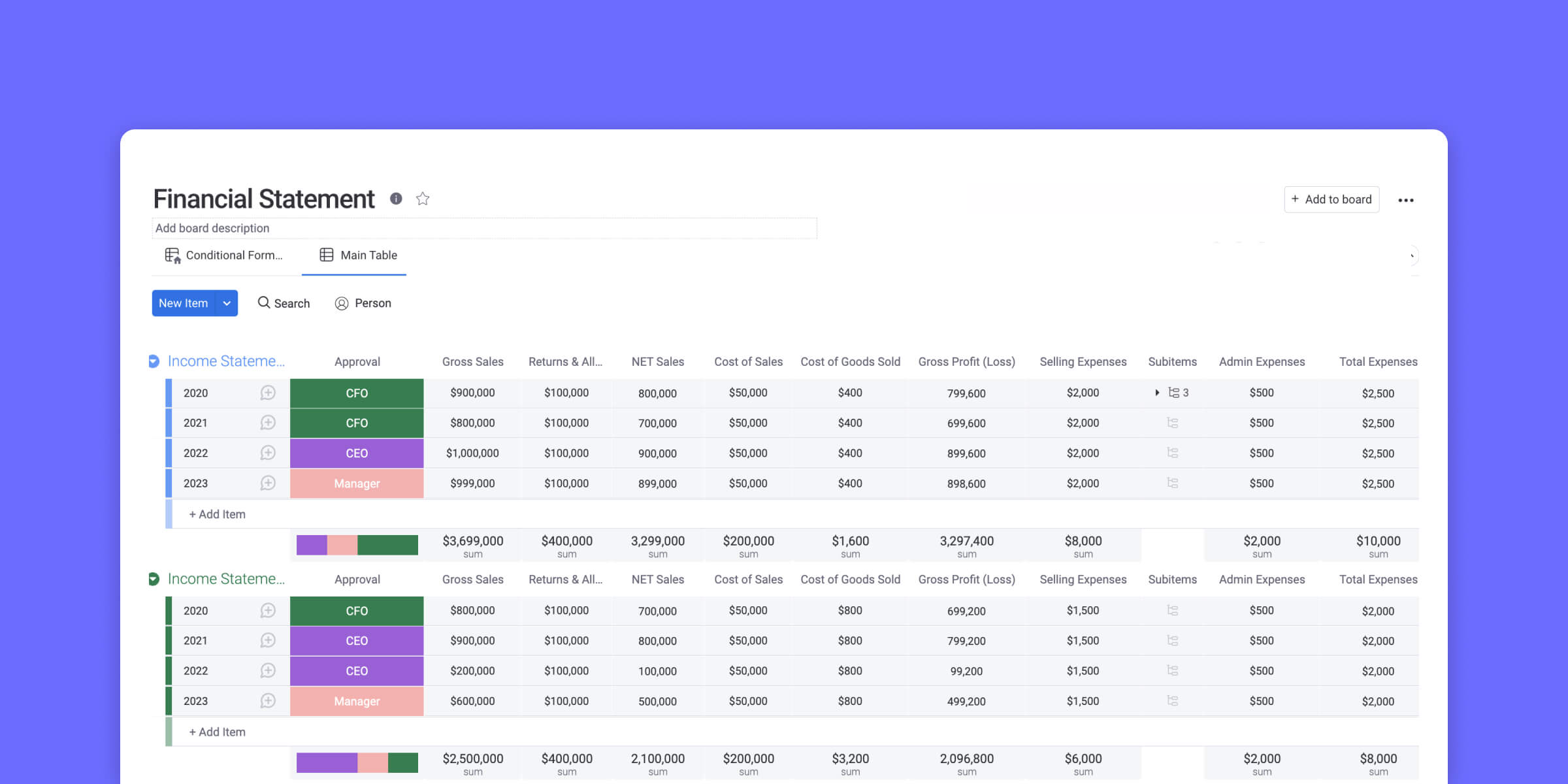

How Do You Use The Roi Formula On Excel Monday Com Blog

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

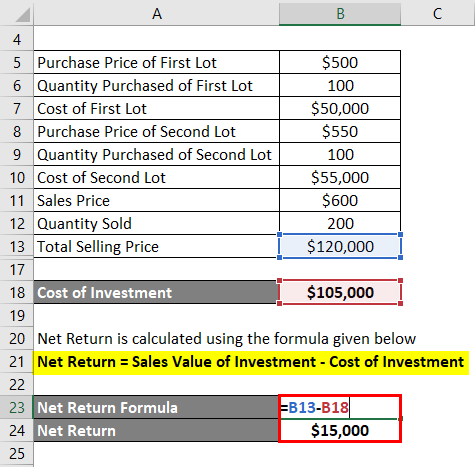

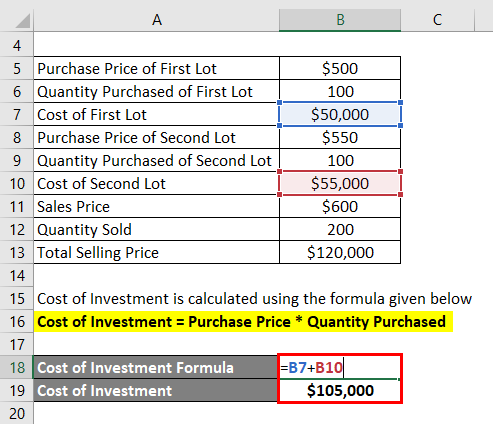

Calculating Return On Investment Roi In Excel

Return On Investment Roi Formula Meaning Investinganswers

Calculating Return On Investment Roi In Excel